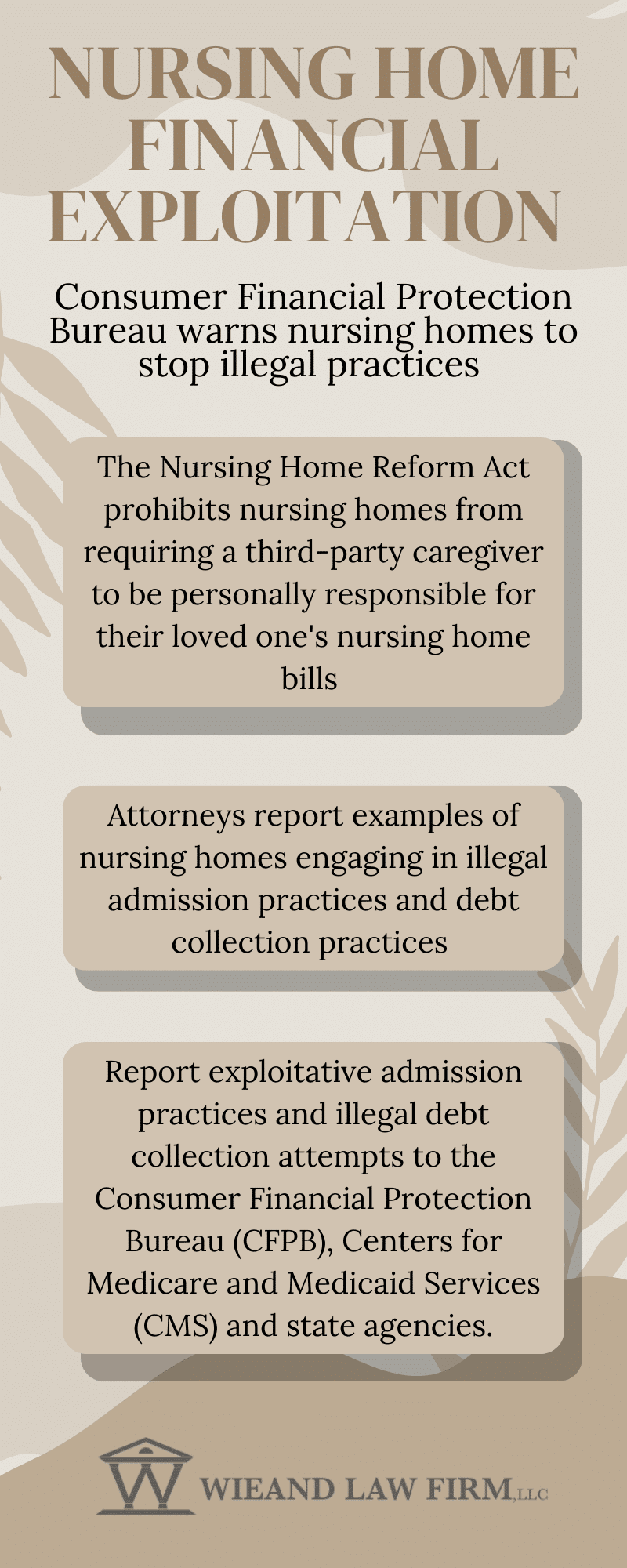

The Consumer Financial Protection Bureau (SFPB) spoke out last week in a field hearing to warning nursing homes to cease financial exploitation during the admissions process. A Philadelphia nursing home abuse lawyer shares that recent media attention has showcased situations in which relatives and friends of residents have been hounded over bad debt, despite federal laws against it. This article explores the questions around nursing home admissions agreements and whether family members and friends can be held liable for nursing home expenses.

The Consumer Financial Protection Bureau (SFPB) spoke out last week in a field hearing to warning nursing homes to cease financial exploitation during the admissions process. A Philadelphia nursing home abuse lawyer shares that recent media attention has showcased situations in which relatives and friends of residents have been hounded over bad debt, despite federal laws against it. This article explores the questions around nursing home admissions agreements and whether family members and friends can be held liable for nursing home expenses.

Seniors may choose to elect an individual, often a family member or a friend, who they want to empower to make decisions for them in the case that they are no longer able to effectively decide for themselves. A Power of Attorney is a legal document that must follow certain guidelines to be enforceable.

The POA may be granted legal authority to:

The creation of a Power of Attorney does NOT mean that the person designated as POA has immediate decision-making rights or responsibilities. The individual can continue making their own decisions until they are no longer competent to do so.

Nursing home care is incredibly expensive. The cost of care in many nursing homes is well over $100,000 per year. Therefore, many POAs or involved family members acting as responsible parties worry what liability they assume for paying nursing home bills.

A POA who has legal authority for financial decisions may be able to sign admissions contracts and to use the resident’s funds to pay for nursing home expenses. However, this does not mean that the POA is responsible to use their own funds to pay for the resident’s nursing home care.

The POA may be responsible to assist the resident in paying nursing home bills from the resident’s accounts. The POA with financial authority may also be responsible to obtain the financial information needed to process a Medicaid application.

In some circumstances, a POA may have personal liability for nursing home expenses. A POA may be personally liable if they do not take the necessary actions to apply for Medicaid when it is necessary. They must obtain and provide the state Medicaid Office with all the necessary documents to approve the application, or they may be sued for expenses incurred by the nursing home.

POAs may also be held liable if they usurp and misuse funds and do not pay the nursing home’s bills.

Basically, there are very limited circumstances in which a POA would be personally liable for nursing home expenses. These circumstances typically involve fraud and deliberate misuse of funds. Contact a nursing home abuse attorney if you have additional questions about your specific situation.

When POAs sign an admission agreement for another party to move to a nursing home, the facility is not permitted to force them to be personally responsible for parents’ nursing home bills. However, some unscrupulous nursing homes may attempt to coerce POAs or other responsible parties to pay. This is not allowed by federal regulation.

According to the Center for Medicare and Medicaid Services (CMS) and Consumer Financial Protection Bureau (CFPB), a nursing care facility may not require a third-party caregiver to personally guarantee payment of a nursing home resident’s expenses. Nursing home admission agreements that require these types of guarantees violate the Nursing Home Reform Act.

Attorneys who testified during the field hearing shared multiple examples in which caregivers have been doggedly pursued by nursing homes, and even suffered wage garnishment and lost their homes, due to debt collection efforts to pay for a loved one’s care. Rohit Chopra, Director of the CFPB, requested that families who are being coerced to pay resident nursing home bills in violation of Nursing Home Reform Act standards to file a complaint with the CFPB, state agencies governing nursing homes, and the Centers for Medicare and Medicaid Services (CMS).

Nursing homes are allowed to discharge residents for the failure to pay their bills after reasonable attempts to collect. The resident must either pay the bill or must make sufficient attempts to apply for Medicaid benefits to pay for their care. The POA may be responsible for helping to assist in these efforts.

The nursing home cannot evict the resident when they exhaust their own funds and rely on Medicaid to pay the bills unless the nursing home is not certified by Medicaid to accept this payment type. If you anticipate that your loved one may need to use Medicaid benefits to pay for their nursing home care, it’s wise to inquire if they accept this payment during the nursing home selection process.

An improper discharge is a form of nursing home abuse. To discharge a resident, the nursing home must make proper arrangements for their medical and social needs. Federal regulations prohibit nursing homes from discharging a resident without making provisions for their care after discharge.

Some nursing homes discharge residents with unpaid bills without making the required safety arrangements. If your loved one is discharged without proper safeguards in place to meet their needs and an injury happens, you can file a personal injury lawsuit.

If your loved one has suffered an injury due to negligence or neglect at a nursing home, call the professional nursing home abuse attorneys at our firm. We have litigated many cases involve injuries that stem from nursing home abuse. Our seasoned lawyers will take the time to closely investigate your situation and discuss your legal options. Call 215-666-7777 or send us a message via the online form on our website to speak directly with an attorney.