On August 5, 2022, New Jersey Governor Phil Murphy signed bill S-481 into law, raising automobile insurance coverage minimums. According to a New Jersey car accident lawyer, this is the first increase to motor vehicle coverage minimums since they were first established 50 years ago. This long overdue increase will help victims of car accidents to claim appropriate monetary compensation for damages caused by a car accident.

On August 5, 2022, New Jersey Governor Phil Murphy signed bill S-481 into law, raising automobile insurance coverage minimums. According to a New Jersey car accident lawyer, this is the first increase to motor vehicle coverage minimums since they were first established 50 years ago. This long overdue increase will help victims of car accidents to claim appropriate monetary compensation for damages caused by a car accident.

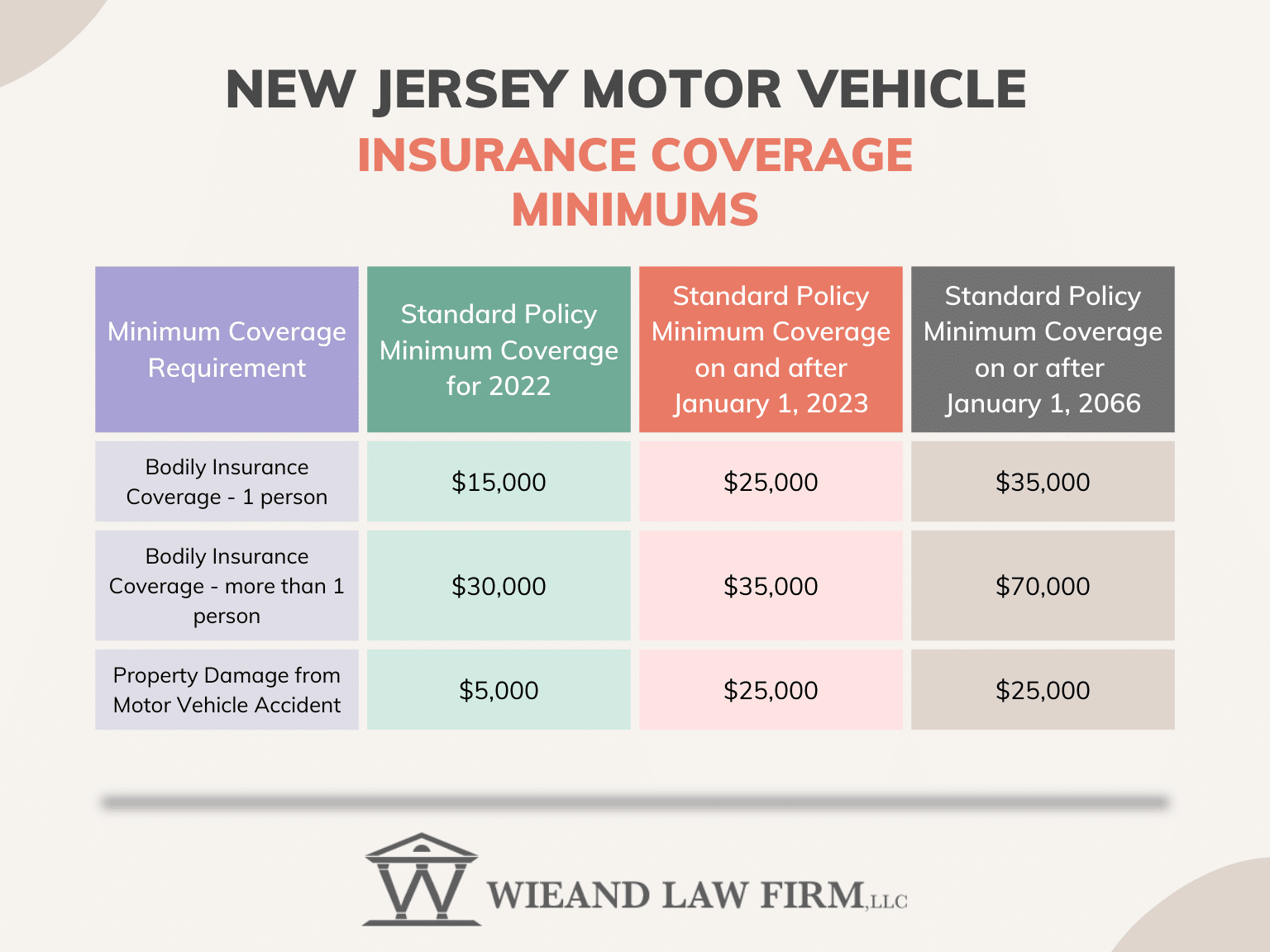

The new law requires that the standard automobile insurance policy to cover $25,000 for bodily injury for a single person involved in an accident for plans renewed on or after January 1, 2023. After January 1, 2026, the minimum coverage for one person in an accident will increase to $35,000.

The legislation also increases the minimum coverage for accidents causing injury to more than one person to $35,000 on or after January 1, 2023. This coverage increases to $70,000 on or after January 1, 2026.

Additionally, the law increases the minimum coverage for property damage caused by a motor vehicle accident to $25,000 effective January 1, 2023. There is no further adjustment to the property damage minimum coverage included in the legislation.

Purchasing a Standard Policy for New Jersey Automobile Insurance means making certain coverage decisions. These choices affect both the price of your insurance and what claims will be paid if an accident occurs. According to a New Jersey car accident lawyer, one of the most important decisions you can make involves your right to sue following a car accident.

There are important differences between selecting an Unlimited Right to Sue and a Limited Right to Sue option under your automobile insurance policy.

An Unlimited Right to Sue allows you to retain your right to sue the person responsible for the car accident for pain in suffering for any injury sustained in the accident.

However, a Limited Right to Sue greatly restricts your ability to hold negligent parties responsible following an auto accident. Under the Limited Right to Sue option, you can ONLY sue for pain in suffering in certain circumstances listed below in which you sustained permanent injury:

If you select a Limited Right to Sue policy, you will still be able to sue for medical expenses and some economic losses within your policy limits. A New Jersey car accident lawyer recommends carrying as much insurance as you can afford and to retain your full rights regarding your ability to sue. Selecting a Limited Right to Sue option can reduce your ability to recover financial compensation for your losses. No one expects to be involved in a serious car accident, but effective planning with your insurance policy can help you to be able to recover financially when tragedy strikes.

Drivers in New Jersey have the option to select basic car insurance coverage. Consumers who select basic insurance coverage have very limited options for recovering compensation after a motor vehicle accident. Basic coverage is typically has less expensive premiums that standard insurance. However, consequences of driving with such low coverage can be significant and very difficult to afford. Under Basic insurance coverage, consumers have few options to suing another driver following a car accident. A New Jersey car accident lawyer encourages consumers to consider the full implications for Basic insurance coverage prior to selecting that option.

The aggressive litigators at the Wieand Law Firm have years of experience fighting insurance companies to ensure that you receive the best possible compensation following a car accident. We strive for exceptional client care by strongly advocating for our clients when insurance adjusters deny or devalue a claim.

Call today to receive a free consultation about your claim. We understand that recovery after a car accident can be overwhelming both physically and financially. We can help you get back on your feet by understanding your legal options available to you and seeking compensation for your losses. Call 215-666-7777 today, or send us a message via the online form in order to speak directly with an attorney.