Older adults who enter a nursing home for skilled nursing and rehabilitation often have a goal to gain back the strength and independence they had prior to their health event. Unfortunately, sometimes a nursing home will try to discharge the resident too early and before they have had enough opportunity to achieve their highest level of independence. This article will explore why premature discharge may occur and inform you on steps to if you believe a loved one is being discharged too early from a nursing home.

Older adults who enter a nursing home for skilled nursing and rehabilitation often have a goal to gain back the strength and independence they had prior to their health event. Unfortunately, sometimes a nursing home will try to discharge the resident too early and before they have had enough opportunity to achieve their highest level of independence. This article will explore why premature discharge may occur and inform you on steps to if you believe a loved one is being discharged too early from a nursing home.

Most older adults who admit to a nursing home for rehab are using their Medicare insurance. Because rehabilitation is a Medicare-covered benefit, nursing facilities must abide by Medicare guidelines.

Under traditional Medicare, a resident is provided with a maximum of 100 days for skilled nursing and rehabilitation. During the first 20 days of their Medicare coverage, Medicare covers the entire cost. Starting day 21, Medicare covers 80% of the cost, and the resident is responsible for a 20% copay. A resident who is covered by a Medicare secondary plan may have insurance coverage for this copay. It’s important to note that 100 days of skilled nursing is the greatest number of days that Medicare will cover; however, residents must continue to meet Medicare guidelines in order continue their benefit days.

Under traditional Medicare, the nursing home staff is given discretion to determine if the patient’s stay continues to meet Medicare guidelines. Typically, the nursing home staff – including nurses, therapists, and dieticians – meet and review a resident’s clinical status and goals. The facility staff compares the resident’s clinical status and outlook to Medicare guidelines and determines whether to:

1) continue skilled nursing and rehabilitation or

2) issue a Notice of Medicare Non-Coverage (NOMNC).

A Notice of Medicare Non-coverage (NOMNC) is a written notice to the resident and family that outlines that Medicare will no longer be covering the resident’s nursing home stay. Medicare requires that a NOMNC provided two days prior to date of non-coverage by insurance. Please note that a two-day notice is NOT a 48-hour notice requirement.

Each Medicare Advantage plan is different, so it’s best to check with your individual plan about coverage and benefits. In many cases, the nursing home staff contacts the Medicare Advantage plan and provides detailed information about the resident’s clinical status, abilities, needs, and goals. Then, the Medicare Advantage plan determines whether the resident will receive additional coverage days, or if they will issue a NOMNC. Often the nursing home staff is still able to decide if the resident meets Medicare guidelines and permitted to issue a NOMNC based on their independent judgment.

There are many reasons that a nursing home may issue a Notice of Medicare Non-Coverage (NOMNC). Most of the time, these reasons are appropriate and within the guidelines of Medicare rules and regulations. However, premature discharges from skilled nursing do occur. Below are a just a few examples that our nursing home injury lawyers have seen when a resident is being discharged too early from a nursing home.

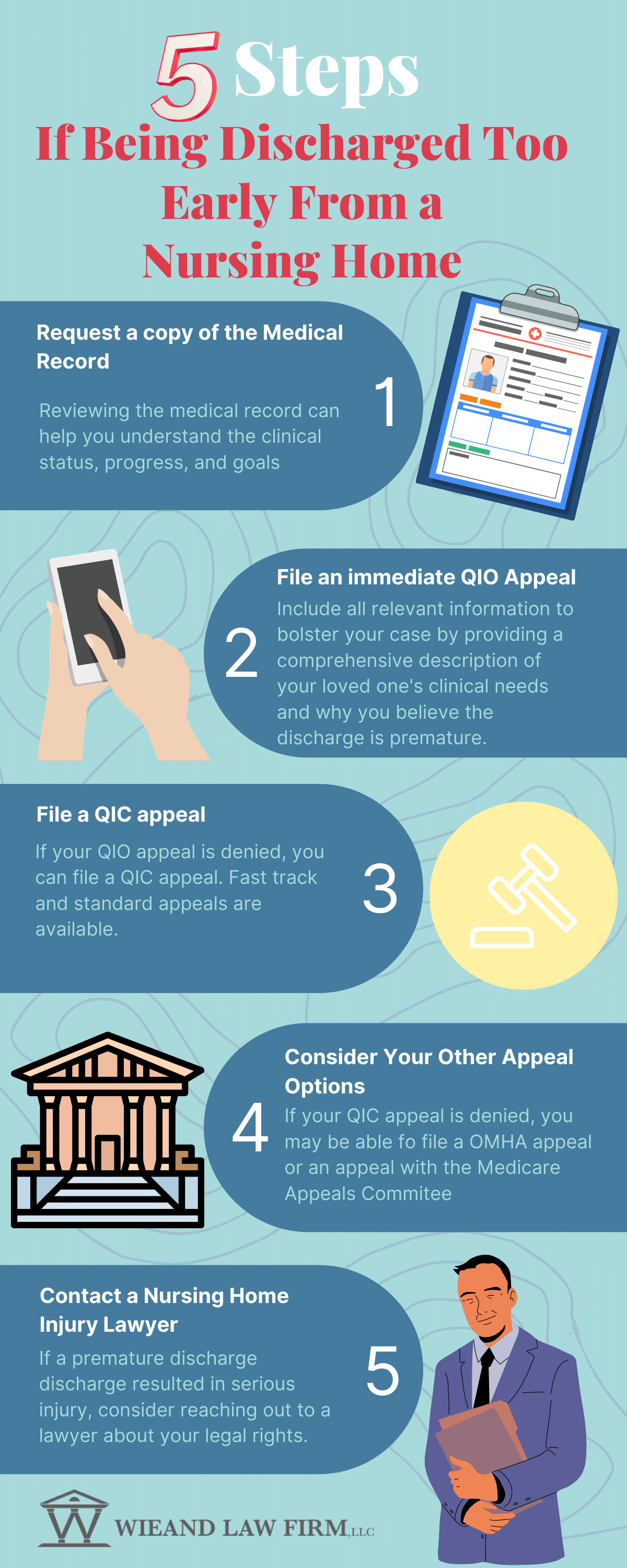

1) Request a copy of your loved one’s medical records. It’s helpful to have a copy of the medical records so that you can read and understand exactly what your loved one’s goals and progress have been during rehabilitation. It will also allow you to speak knowledgeably about their clinical status during a Medicare Appeal.

2) File an immediate QIO Appeal. The Notice of Medicare Non-coverage (NOMNC) includes the information on to file an appeal if you disagree with the determination of non-coverage. You can make an appeal to the Quality Improvement Organization (QIO) is referred to as a fast-track appeal. Be sure to file your appeal no later than noon the day before your last covered Medicare day to be eligible for this appeal.

Make sure that the nursing home provides you with a form called a Detailed Explanation of Non-Coverage (DENC). This form explains why the Medicare coverage is ending and any applicable rules that are related to your case. This form will help you understand the reasons for the Medicare non-coverage so that you can address why you believe your loved one is being discharged too early from a nursing home.

When you speak with the representative, provide a comprehensive description of your loved one’s clinical needs and explain fully why you believe the discharge is premature. Include any information that bolsters your case. For example, does your loved one have 3 steps to enter the home and the nursing home hasn’t practiced stairs yet? Or, does your loved one’s discharge require complex planning to implement services and equipment needed for a safe discharge that cannot be completed in the timeframe provided? State clear, specific, and achievable goals that have not been met to explain the reason you are requesting additional time under their Medicare benefit.

If you miss the deadline for a fast-track appeal, you still have appeal options to appeal. This information is also listed on the Notice of Medicare Non-Coverage (NOMNC). Below is a sample NOMNC form.

3) If Denied, Consider a QIC Appeal. If the Quality Improvement Organization (QIO) denies your appeal, you may file a Qualified Independent Contractor (QIC) appeal. Make a fast-track appeal by filing no later than noon the day following the decision by the QIO. The QIC will provide a decision within 72 hours. The nursing home is not allowed to bill you for care until they receive the answer from the QIC. Unfortunately, if the QIC denies your appeal, you are on the hook for any costs incurred during the review period.

If you miss the deadline for a QIC fast-track appeal, you can file a standard appeal within 180 days. The QIC then has 60 days to provide a decision.

4) Other Appeal Options. Denied appeals can be further taken to the Office of Medicare Hearings and Appeals (OMHA) within 60 days of a QIC denial. Additionally, you can appeal to the Medicare Appeals Committee within 60 days of a OMHA denial.

5) Contact a Nursing Home Injury Lawyer. Sometimes residents and their families are not provided with full information about their appeal rights and subsequently aren’t able to prevent being discharged too early from a nursing home. If a premature discharge results in a subsequent serious injury that could have been avoided with appropriate care, you may want to consider contacting a nursing home injury lawyer.

At the Wieand Law Firm, we know nursing homes. Contact one of our experienced nursing home injury lawyers for a full case review and evaluation. Our consultations are always free. In fact, we never earn a cent unless we win money for your case. Call us today at 215-666-7777 to speak directly with an attorney about your legal options.